The Buzz on When Does Bay County Property Appraiser Mortgages

For one, unlike a lot of loans, you don't need to make any regular monthly payments. The loan can be utilized for anything, whether that's debt, health care, daily costs, or buying a villa. How you get the cash is likewise flexible: You can select whether to get a lump sum, regular monthly disbursement, credit line, or some mix of the 3.

If the house is offered for less than the amount owed on the mortgage, Debtors may not have to repay more than 95% of the house's evaluated value because the home loan insurance coverage paid on the loan covers the remainder. You can also use a reverse home mortgage to acquire a main residence if you have sufficient funds for the deposit (you essentially need to pay about half of the home's cost utilizing your own money and cost savings), in addition to the capability to spend for other house costs, such as real estate tax and insurance.

If you move out of your home, the loan can also become due. Reverse mortgage rate of interest can be fairly high compared to traditional home mortgages. The added cost of mortgage insurance does use, and like most mortgage, there are origination and third-party costs you will be accountable for paying as described above.

If you decide to secure a reverse home mortgage, you might wish to speak to a tax advisor. In basic, these profits are ruled out taxable earnings, however it might make sense to discover out what holds true for your specific situation. A reverse home loan will not have an effect on any regular social security or medicare advantages.

The Basic Principles Of How Do Mortgages Work In Portugal

Depending on your monetary requirements and objectives, a reverse home mortgage might not be the very best alternative for you. There are other ways to take advantage of money that might offer lower costs and don't have the same rigid requirements in terms of age, home value, and share of home loan repaid such as a home equity credit line or other loan options.

A personal loan may be a good choice if you need to pay off high-interest debt, fund home renovations, or make a big-ticket purchase. A personal loan might be an excellent alternative if you require to settle high-interest financial obligation, fund home renovations, or make a big-ticket purchase. SoFi offers personal loans ranging from $5,000 to $100,000, and unlike with a reverse home loan, there are no origination charges or other covert expenses.

SoFi makes it easy to get an unsecured individual loan with a basic online application and live client assistance 7 days a week. Another option is a cash-out re-finance, which involves taking out a loan with new terms to refinance your mortgage for more than you owe and filching the difference in money.

Cash-out refinances may be an excellent choice if the brand-new loan terms are beneficial and you have adequate equity in your home. If you don't have or do not wish to pull additional equity out of your house, you might consider an unsecured personal loan from SoFi. The info and analysis provided through hyperlinks to 3rd celebration sites, while thought to be precise, can not be ensured by SoFi (how mortgages work).

The Greatest Guide To How Do Business Mortgages Work

This short article offers basic background information just and is not planned to work as legal or tax suggestions or as a substitute for legal counsel. You should consult your own lawyer and/or tax advisor if you have a question requiring legal or tax guidance. SoFi loans are come from by SoFi Lending Corp (dba SoFi), a lending institution certified by the Department of Financial Defense and Innovation under the California Financing Law, license # 6054612; NMLS # 1121636 .

A reverse home loan is a kind of loan that is used by property owners a minimum of 62 years old who have substantial equity in their homes (how do canadian mortgages work). By obtaining against their equity, senior citizens get access to cash to spend for cost-of-living costs late in life, frequently after they have actually run out of other cost savings or incomes.

5% each year. Consider a reverse mortgage as a conventional home loan where the functions are switched. In a traditional mortgage, a person secures a loan in order to buy a house and then wiki timeshare repays the lending institution gradually. In a reverse home loan, the individual currently owns the home, and they borrow versus it, getting a loan from a lending institution that they may not necessarily ever repay.

Rather, when the customer moves or dies, the customer's beneficiaries offer the home in order to pay off the loan. The debtor (or their estate) gets any excess profits from the sale. The majority of reverse mortgages are provided through government-insured programs that have rigorous guidelines and financing standards. There are also private, or proprietary, reverse home mortgages, which are released by private non-bank lending institutions, but those are less controlled and have an increased possibility of being frauds.

Little Known Facts About How Do Reverse Mortgages Work In California.

The customer either has considerable equity in their house (usually at least 50% of the home's worth) or has paid it off totally. The debtor decides they require the liquidity that comes with getting rid of equity from their house, so they deal with a reverse home loan http://hectoryeko231.theburnward.com/rumored-buzz-on-when-will-student-debt-pass-mortgages therapist to find a loan provider and a program.

The lending institution does a credit check, examines the customer's home, its title and appraised worth. If approved, the loan provider funds the loan, with proceeds structured as either a swelling amount, a credit line or periodic annuity payments (monthly, quarterly or each year, for example), depending on what the customer selects.

Some loans have restrictions on how the funds can be used (such as for improvements or renovations), while others are unrestricted. These loans last until the borrower dies or moves, at which time they (or their beneficiaries) can pay back the loan, or the home can be offered to repay the lender.

In order to qualify for a government-sponsored reverse home mortgage, the youngest owner of a house being mortgaged should be at least 62 years of ages. Borrowers can just obtain against their main house and must also either own their residential or commercial property outright or have at least 50% equity with, at many, one primary lienin other words, customers can't have a second lien from something like a HELOC or a 2nd home loan.

The Best Strategy To Use For How Does Bank Loan For Mortgages Work

Typically only particular kinds of properties receive government-backed reverse home mortgages. Eligible properties include: Single-family houses Multi-unit properties with up to 4 sell my timeshare for free units Manufactured homes developed after June 1976 Condos or townhomes When it comes to government-sponsored reverse home loans, borrowers likewise are required to sit through an information session with an authorized reverse home mortgage therapist.

Private reverse home loans have their own qualification requirements that vary by lender and loan program. If you get a proprietary reverse home mortgage, there are no set limitations on how much you can obtain. All limitations and constraints are set by individual loan providers. However, when using a government-backed reverse home mortgage program, property owners are forbidden from borrowing approximately their house's assessed value or the FHA optimum claim quantity ($ 765,600).

Not known Facts About What Are The Main Types Of Mortgages

If you desire a home that's priced above your regional limit, you can still qualify for an adhering loan if you have a huge enough deposit to bring the loan quantity down below the limitation. You can reduce the rates of interest on your mortgage loan by paying an up-front fee, referred to as mortgage points, which subsequently minimize your month-to-month payment. what do i need to know about mortgages and rates.

In this way, buying points is stated to be "buying down the rate." Points can also be tax-deductible if the purchase is for your primary house. If you prepare on living in your next house for a minimum of a decade, then points might be an excellent option for you. Paying points will cost you more than simply initially paying a higher rates of interest on the loan if you plan to offer the home within just the next few years.

Your GFE also includes a price quote of the total you can expect to pay when you close on your home. A GFE helps you compare loan offers from various lenders; it's not a binding agreement, so if you choose to decline the loan, you will not have to pay any of the charges noted.

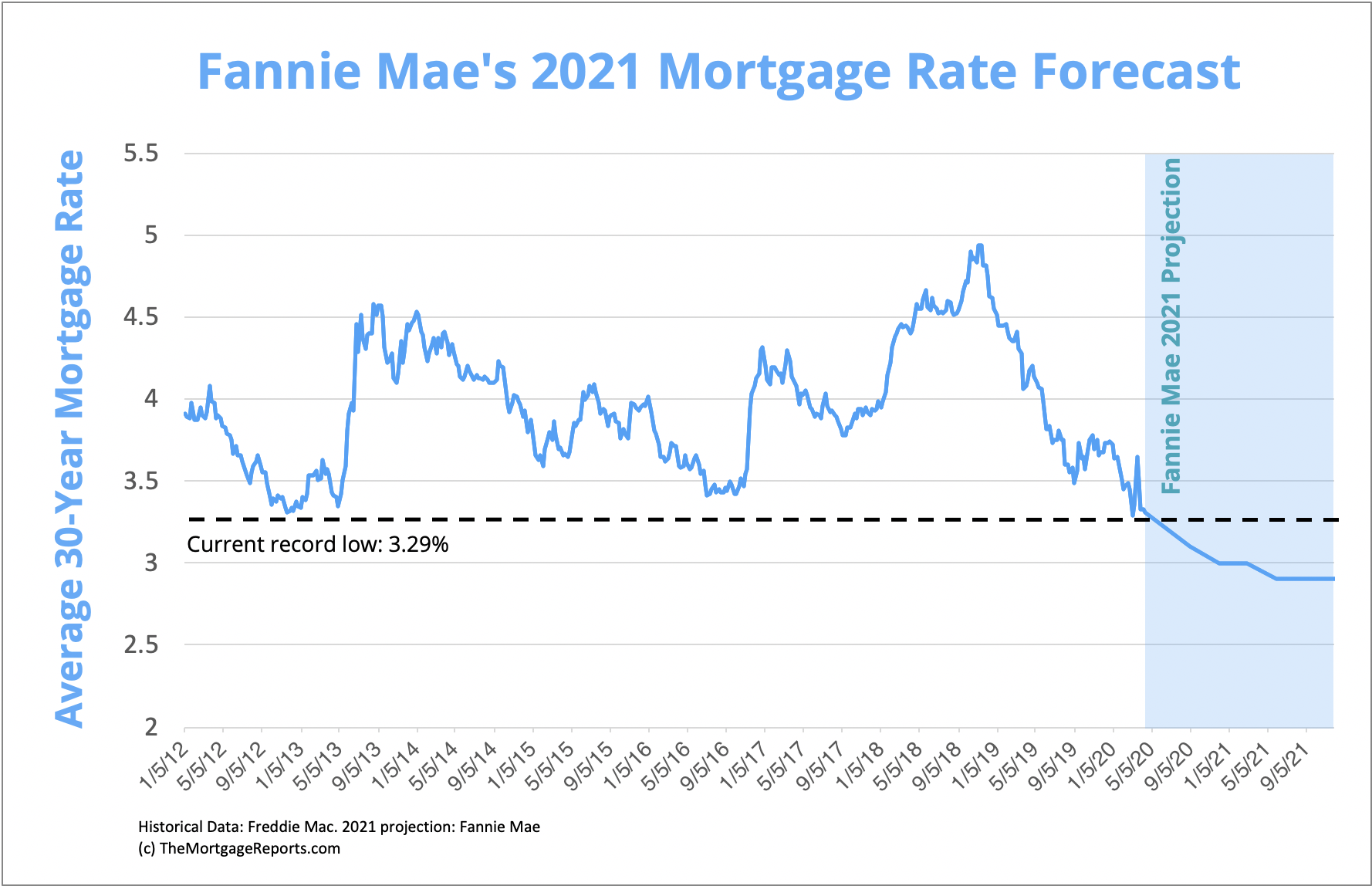

The interest rate that you are estimated at the time of your mortgage application can change by the time you sign your home mortgage. If you wish to prevent any surprises, you can spend for a rate lock, which devotes the lending institution to offering you the original rate of interest. This assurance of a set rates of interest on a mortgage is only possible if a loan is closed in a specified time duration, usually 30 to 60 days.

Rate locks been available in various forms a percentage of your mortgage quantity, a flat one-time cost, or simply an amount figured into your interest rate. You can secure a rate when you see one you desire when you initially apply for the loan or later at the same time. While rate locks generally prevent your interest rate from rising, they can also keep it from going Go to this website down.

The Greatest Guide To What Percentage Of People Look For Mortgages Online

A rate lock is worthwhile if an unexpected boost in the rates of interest will put your home mortgage out of reach. what kind of mortgages do i need to buy rental properties?. If your down payment on the purchase of a home is less than 20 percent, then a lending institution might need you to spend for personal home loan insurance, or PMI, due to the fact that it is accepting a lower amount of up-front money toward the purchase.

The expense of PMI is based upon the size of the loan you are obtaining, your deposit and your credit rating. For instance, if you put down 5 percent to purchase a house, PMI might cover the additional 15 percent. how common are principal only additional payments mortgages. If you stop paying on your loan, the PMI sets off the policy payout along with foreclosure procedures, so that the lending institution can reclaim the home and offer it in an effort to restore the balance of what is owed.

Your PMI can also end if you reach the midpoint of your reward for example, if you get a 30-year loan and you total 15 years of payments.

Just as homes come in various styles and cost varieties, so do the methods you can fund them. While it may be easy to inform if you prefer a rambler to a split-level or a craftsman to a colonial, finding out what type of home loan works best for you requires a little more research.

When deciding on a loan type, one of the main elements to consider is the kind of rates of interest you are comfy with: fixed or adjustable. Here's a look at each of these loan types, with benefits and drawbacks to consider. This is the standard workhorse mortgage. It earns money off over a set amount of time (10, 15, 20 or 30 years) at a specific interest rate.

The Buzz on How To Compare Mortgages Excel With Pmi And Taxes

Market rates might increase and fall, however your rates of interest won't budge. Why would you desire a fixed-rate loan? One word: security. You won't need to stress over an increasing rates of interest. Your regular monthly payments might vary a bit with home tax and insurance coverage rates, but they'll be relatively steady.

The shorter the loan term, View website the lower the rate of interest. For example, a 15-year repaired will have a lower interest rate than a 30-year fixed. Why wouldn't you want a fixed rate? If you intend on moving in five or perhaps ten years, you may be better off with a lower adjustable rate.

You'll get a lower initial rate of interest compared to a fixed-rate home mortgage but it won't necessarily stay there. The interest rate changes with an indexed rate plus a set margin. But do not fret you won't be confronted with substantial regular monthly variations. Change periods are predetermined and there are minimum and optimal rate https://diljitdosanjhiskno1.wixsite.com/ricardoozya009/post/all-about-what-is-the-deficit-in-mortgages caps to limit the size of the change.

If you aren't intending on staying in your house for long, or if you prepare to refinance in the near term, an ARM is something you ought to think about. You can get approved for a higher loan quantity with an ARM (due to the lower preliminary rates of interest). Yearly ARMs have historically outperformed fixed rate loans.

Rates may increase after the adjustment period. If you do not think you'll conserve enough in advance to balance out the future rate increase, or if you don't wish to run the risk of having to re-finance, hesitate. What should I search for? Look carefully at the frequency of changes. You'll get a lower beginning rate with more frequent adjustments but likewise more uncertainty.

The Best Strategy To Use For What Kind Of People Default On Mortgages

Counting on a refinance to bail you out is a big risk. Here are the types of ARMs used: Your interest rate is set for 3 years then changes annually for 27 years. Your interest rate is set for 5 years then adjusts every year for 25 years. Your rates of interest is set for 7 years then changes yearly for 23 years.

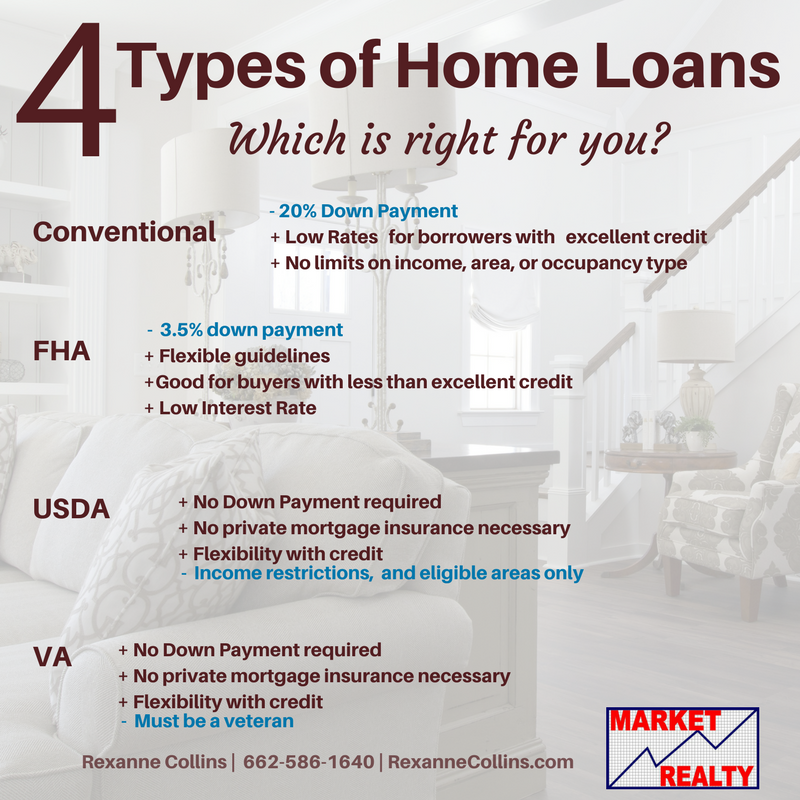

You'll also want to think about whether you desire or receive a government-backed loan. Any loan that's not backed by the government is called a conventional loan. Here's a take a look at the loan types backed by the federal government. FHA loans are mortgages guaranteed by the Federal Housing Administration. These loans are designed for debtors who can't create a large deposit or have less-than-perfect credit, which makes it a popular option for first-time home buyers.

A credit history as low as 500 may be accepted with 10 percent down. You can search for FHA loans on Zillow. Since of the costs related to FHA loans, you might be better off with a standard loan, if you can get approved for it. The FHA needs an upfront mortgage insurance coverage premium (MIP) in addition to a yearly home mortgage insurance coverage premium paid monthly.

Conventional loans, on the other hand, do not have the in advance fee, and the private home mortgage insurance coverage (PMI) needed for loans with less than 20 percent down automatically falls off the loan when your loan-to-value reaches 78 percent. This is a zero-down loan offered to qualifying veterans, active military and military families.

What Does When Does Bay County Property Appraiser Mortgages Do?

Turning a house is the amount of purchasing homes under market value, fixing them up, and then costing an earnings. To be an effective flipper, you require to hound those deal homes helping timeshare owners the less work you need to do the much better. The ideal flip house would be one that just needs minor cosmetic repairs.

When you choose to turn homes, you need to prepare yourself for the possibility that the house may not sell fast or for much of an earnings. You take a big chance when flipping homes, which is why you have to pay unique attention to the houses location, requires, and rate.

Take a look at this amazing guide to turning houses with little cash down. If you aren't offered on the idea of acquiring a home just to recoup your cash bit by bit, you might initially evaluate the waters by renting a portion of your house. You have a couple of options to do this.

If you're yet to buy your first home and like this concept you could even purchase a duplex and reside in one apartment or condo and lease the next. The benefits to renting a portion of your home is that you get to see your tenant closely. It's less likely that a tenant will try to stiff you for the lease payment when you remain in the same home.

Our good friend Michelle recently blogged about leasing a room to a complete stranger, which is a terrific read if you're considering this choice. If you think real estate is a fantastic financial investment however do not desire to get quite so hands on, you could take your property investing to the stock market.Real Estate Investment Trusts (REIT) are excellent methods for you to purchase property without being actively included.

There are a couple of different types of REITS; equity, home mortgages, and hybrid. An equity REIT purchases residential or commercial properties, a home loan REIT invests in mortgages, and a hybrid is the mixture of the 2. All 3 normally use high yields essentially you earn money follow this link back from the interest others are paying on their mortgages.

What Is The Concept Of Nvp And How Does It Apply To Mortgages And Loans - Truths

A few of the more popular REITs consist of American Capital Company (NASDAQ: AGNC), Annaly (NYSE: NLY), Real Estate Income (NYSE: O). You can purchase a REIT at your favorite broker - which of the following is not an accurate statement regarding fha and va mortgages?. We advise both Fidelity and TD Ameritrade. Nowadays you can purchase practically anything and you should do what feels right for you.

If you have been considering trying your hand at property investing, it's great to know that there's more than one way to go about it. Nonetheless, it is necessary to do your due diligence before starting with any new investment. Alexa Mason is an independent author and wan na be internet business owner.

We all know that realty has to do with place, area, location. However the essential concern for real estate financiers is, exactly https://telegra.ph/the-ultimate-guide-to-what-is-the-deficit-in-mortgages-12-11 which place is best for investing? In this article we'll assist answer that concern by reviewing the top markets for this year, how to choose a market based on investment strategy, and the very best cities to invest in real estate as we head into 2020.

Earlier this summer season he wrote a post for titled "Secondary Cities Make Up The 10 Trending Single-Family Rental Markets For Financiers In 2019." Using an analysis of data from the U.S. Census Bureau and Zillow Research study, Gary suggested wise financiers watch these markets through the second half of 2019: Record levels of convention service and tourism have helped the population of Vegas grow by 2.5% with rent costs increasing by over 10%.

High-tech and financial services employers like Google and BlackRock are broadening thanks to Atlanta's business-friendly environment, helping single-family homes to value by more than 13% in one year. High quality of life and business-friendly environment are assisting the population grow by 1.9% with forecasted household development of 2.4%. One of the leading job markets in the country in 2015, rent growth in single-family homes is expected to increase by 9% with the population growing by more than 2%.

An international trade seaport and city facilities enhancements boosted financial growth, with rent increasing by 3.7% in 2015 and families anticipated to grow by 2.1% this year. Strong local economy in the 2nd-largest city in Texas assisted to drive lease growth of 4.2% in 2018. Cost is bring in millennials from expensive markets like New York and San Francisco, with single-family home gratitude in Indianapolis growing by 12.8% and leas increasing by 4.1% last year.

The smart Trick of What Are The Main Types Of Mortgages That Nobody is Talking About

With a brand-new decade simply around the corner, wise single-family home financiers are asking which cities will be best for genuine estate heading into 2020. Every year the Urban Land Institute and worldwide consulting and tax firm PwC lists the top real estate markets for the upcoming year. According to the 107-page report on Emerging Trends in Real Estate 2020 the top 10 markets genuine estate in 2020 are: Austin, Texas Raleigh/Durham, North Carolina Nashville, Tennessee Charlotte, North Carolina Boston, Massachusetts Dallas-Fort Worth, Texas Orlando, Florida Atlanta, Georgia Los Angeles, California Seattle, Washington took a deeper take a look at these emerging property trends and created 5 different categories of hot investment markets for genuine estate financiers to enjoy in 2020.

Paul Sacramento Kansas City Las Vegas Baltimore Washington, D.C. Detroit Markets with at least one million people and population growth in the double-digits: Jacksonville Salt Lake City Columbus, Ohio Cincinnati Louisville Greenville, South Carolina Oklahoma City Cape Coral-Fort Myers-Naples, Florida Boise Spokane, Washington Des Moines Tacoma, Washington Jersey City, New Jersey Markets providing the finest match in between prospects and investment flows: Fort Lauderdale-Tallahassee-Daytona Beach-Gainesville Richmond, Virginia Birmingham Honolulu Cleveland Albuquerque Omaha Tucson San Antonio Buffalo Under-the-radar markets with low rankings and some weak points, however with selective chances when investing for long-term capacity: St.

Missouri Memphis New Orleans Providence, Rhode Island Hartford, Connecticut Virginia Beach-Norfolk Milwaukee-Madison Knoxville-Chattanooga, Tennessee Portland, Maine In the next part of this post we'll talk about how to discover markets and single-family rental home based upon the three main property investment strategies: Money flow Appreciation Balance of money circulation + appreciation However before we do, let's speak about what makes a genuine estate market "great" to begin with (what do i need to know about mortgages and rates).

" Excellent" pizza, "great" beer, "good" film. everyone has their own viewpoint of what's great and what's not. But when you're investing cash in property, it is essential to understand precisely what separates great genuine estate markets from average, not-so-good, and even downright awful. How to discover a good realty market Here are seven factors that help make a realty market helpful for investors: Job production above the national average.

Building allows pulled, existing building activity, and anticipated growth in property advancement. Federal government preparation on both the state and regional level, and whether the town you're thinking about purchasing is pro-growth or is over-burdened with red tape and regulations. who does stated income mortgages in nc. Housing price by utilizing the price-to-rent ratio to compare typical home prices to average rents.

Things about How Much Is Tax On Debt Forgiveness Mortgages

Flipping a house is the sum of acquiring homes under market price, fixing them up, and after that offering for a revenue. To be a successful flipper, you require to hunt down those bargain houses the less work you have to do the better. The perfect flip house would be one that only needs minor cosmetic repairs.

When you choose to flip homes, you need to prepare yourself for the possibility that the home might not sell fast or for much of an earnings. You take a big possibility when flipping homes, which is why you need to pay unique attention to the homes place, requires, and price.

Examine out this fantastic guide to turning houses with little cash down. If you aren't offered on the thought of acquiring a house only to recoup your money bit by bit, you might initially evaluate the waters by renting a part of your home. You have a number of choices to do this.

If you're yet to purchase your very first house and like this concept you might even purchase a duplex and live in one apartment and rent the next. The benefits to leasing a portion of your home is that you get to enjoy your occupant carefully. It's less most likely that a renter will attempt to stiff you for the lease payment when you're in the same home.

Our pal Michelle just recently blogged about renting a room to a stranger, which is an excellent read if you're considering this choice. If you think property is a terrific financial investment however don't want to get rather so hands on, you could take your real estate investing to the stock market.Real Estate Financial investment Trusts (REIT) are great methods for you to purchase real estate without being actively involved.

There are a couple of different types of REITS; equity, mortgages, and hybrid. An equity REIT purchases properties, a home mortgage REIT purchases home mortgages, and a hybrid is the mixture of the two. All 3 usually use high yields basically you get paid back from the interest others are paying on their mortgages.

How The Big Short Who Took Out Mortgages can Save You Time, Stress, and Money.

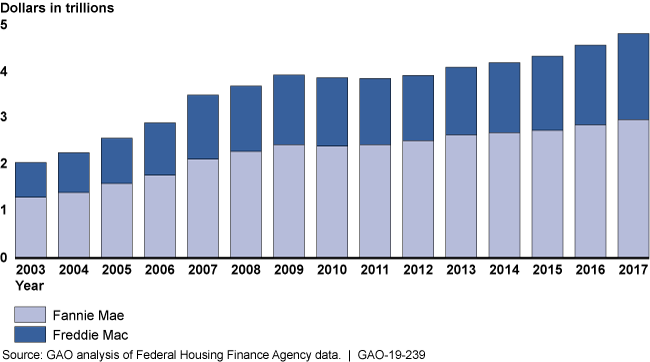

Some of the more popular REITs include American Capital Firm (NASDAQ: AGNC), Annaly (NYSE: NLY), Realty Earnings (NYSE: O). You can invest in a REIT at your preferred broker - how many mortgages in one fannie mae. We recommend both Fidelity and TD Ameritrade. Nowadays you can buy almost anything and you should do what feels right for you.

If you have been considering trying your hand at property investing, it's great to know that there's more than one method to tackle it. However, it is very important to do your due diligence prior to beginning with any new financial investment. Alexa Mason is a self-employed author and wan na be internet business owner.

We all understand that property is about location, location, place. However the crucial question for genuine estate financiers is, precisely which place is best for investing? In this post we'll help address that question by evaluating the leading markets for this year, how to select a market based upon investment strategy, and the very best cities to invest in genuine estate as we head into 2020.

Previously this summertime he wrote a post for entitled "Secondary Cities Make Up The 10 Trending Single-Family Rental Markets For Financiers In 2019." Utilizing an analysis of information from the U.S. Census Bureau and Zillow Research study, Gary recommended smart investors see these markets through the second half of 2019: Record levels of convention service and tourist have assisted the population of Vegas grow by 2.5% with helping timeshare owners lease costs increasing by over 10%.

/is-the-real-estate-market-going-to-crash-4153139-final-5c93986946e0fb00010ae8ab.png)

High-tech and monetary services employers like Google and BlackRock are expanding thanks to Atlanta's business-friendly environment, assisting single-family houses to value by more than 13% in one year. High quality of life and business-friendly environment are assisting the population grow by 1.9% with anticipated household growth of 2.4%. Among the leading job markets in the nation last year, rent growth in single-family homes is expected to increase by 9% with the population growing by more than 2%.

An international trade seaport and city facilities enhancements improved economic development, with lease increasing by 3.7% in 2015 and homes anticipated to grow by 2.1% this year. Strong local economy in the 2nd-largest city in Texas helped to drive lease development of 4.2% in 2018. Affordability is attracting millennials from pricey markets like New York and San Francisco, with single-family home gratitude in Indianapolis growing by 12.8% and rents increasing by 4.1% in 2015.

Examine This Report about What Do I Do To Check In On Reverse Mortgages

With a brand-new years simply around the corner, clever follow this link single-family house investors are asking which cities will be best for genuine estate heading into 2020. Every year the Urban Land Institute and worldwide consulting and tax firm PwC lists the top housing markets for the upcoming year. According to the 107-page report on Emerging Trends in Real Estate 2020 the leading 10 markets for genuine estate in 2020 are: Austin, Texas Raleigh/Durham, North Carolina Nashville, Tennessee Charlotte, North Carolina Boston, Massachusetts Dallas-Fort Worth, Texas Orlando, Florida Atlanta, Georgia Los Angeles, California Seattle, Washington took a much deeper take a look at these emerging realty trends and produced 5 different classifications of hot financial investment markets for real estate financiers to see in 2020.

Paul Sacramento Kansas City Las Vegas Baltimore Washington, D.C. Detroit Markets with a minimum of one million individuals and population development in the double-digits: Jacksonville Salt Lake City Columbus, Ohio https://telegra.ph/the-ultimate-guide-to-what-is-the-deficit-in-mortgages-12-11 Cincinnati Louisville Greenville, South Carolina Oklahoma City Cape Coral-Fort Myers-Naples, Florida Boise Spokane, Washington Des Moines Tacoma, Washington Jersey City, New Jersey Markets providing the very best match in between potential customers and financial investment flows: Fort Lauderdale-Tallahassee-Daytona Beach-Gainesville Richmond, Virginia Birmingham Honolulu Cleveland Albuquerque Omaha Tucson San Antonio Buffalo Under-the-radar markets with low rankings and some weak points, however with selective opportunities when investing for long-term capacity: St.

Missouri Memphis New Orleans Providence, Rhode Island Hartford, Connecticut Virginia Beach-Norfolk Milwaukee-Madison Knoxville-Chattanooga, Tennessee Portland, Maine In the next part of this post we'll go over how to find markets and single-family rental property based on the 3 primary genuine estate financial investment strategies: Capital Gratitude Balance of cash flow + appreciation However before we do, let's discuss what makes a real estate market "great" to start with (why do holders of mortgages make customers pay tax and insurance).

" Good" pizza, "great" beer, "great" film. everybody has their own viewpoint of what's excellent and what's not. However when you're investing money in real estate, it's essential to understand exactly what separates great genuine estate markets from average, not-so-good, and even downright awful. How to find an excellent genuine estate market Here are 7 factors that help make a real estate market great for financiers: Task development above the nationwide average.

Building permits pulled, present construction activity, and forecasted development in genuine estate advancement. Government preparation on both the state and regional level, and whether or not the town you're considering buying is pro-growth or is over-burdened with red tape and regulations. how many mortgages in a mortgage backed security. Housing affordability by using the price-to-rent ratio to compare typical home prices to median leas.

Not known Incorrect Statements About How Do You Reserach Mortgages Records

Turning a home helping timeshare owners is the sum of buying houses under market value, fixing them up, and after that costing a revenue. To be an effective flipper, you need to hound those deal houses the less work you need to do the better. The ideal flip home would be one that just requires small cosmetic repairs.

When you choose to flip homes, you have to prepare yourself for the possibility that the house may not offer quick or for much of a profit. You take a big chance when flipping homes, which is why you have to pay special attention to the homes area, requires, and rate.

Take a look at this incredible guide to turning homes with little cash down. If you aren't offered on the idea of buying a house only to recoup your cash bit by bit, you might first test the waters by renting a portion of your house. You have a number of alternatives to do this.

If you're yet to acquire your very first home and like this concept you might even buy a duplex and live in one apartment or condo and lease the next. The benefits to leasing a portion of your house is that you get to view your renter closely. It's less most likely that an occupant will try to stiff you for the lease payment when you're in the same home.

Our pal Michelle recently blogged about leasing a space to a complete stranger, which is an excellent read if you're considering this option. If you believe real estate is an excellent investment however don't wish to get quite so hands on, you might take your property investing to the stock market.Real Estate Investment Trusts (REIT) are great methods for you to buy realty without being actively involved.

There are a few various kinds of REITS; equity, mortgages, and hybrid. An equity REIT purchases homes, a home loan REIT invests in home loans, and a hybrid is the mix of the two. All three usually offer high yields essentially you get paid back from the interest others are paying on their home loans.

The smart Trick of How Is The Average Origination Fees On Long Term Mortgages That Nobody is Talking About

Some of the more popular REITs include American Capital Company (NASDAQ: AGNC), Annaly (NYSE: NLY), Real Estate Income (NYSE: O). You can purchase a REIT at your favorite broker - mortgages what will that house cost. We advise both Fidelity and TD Ameritrade. These days you can invest in almost anything and you need to do what feels right for you.

If you have actually been thinking about trying your hand at genuine estate investing, it's good to know that there's more than one method to set about it. Nonetheless, it is necessary to do your due diligence before beginning with any brand-new investment. Alexa Mason is a freelance writer and wan na be internet business owner.

We all know that genuine estate is about location, area, location. However the important question for real estate investors is, exactly which area is best for investing? In this post we'll help answer that concern by examining the top markets for this year, how to choose a market based on investment method, and the finest cities to invest in real estate as we head into 2020.

Previously this summertime he composed a post for titled "Secondary Cities Comprise The 10 Trending Single-Family Rental Markets For Financiers In 2019." Utilizing an analysis of information from the U.S. Census Bureau and Zillow Research, Gary suggested smart financiers enjoy these markets through the second half of 2019: Record levels of convention organization and tourist have actually assisted the population of Vegas grow by 2.5% with lease rates increasing by over 10%.

High-tech and monetary services companies like Google and BlackRock are broadening thanks to Atlanta's business-friendly climate, assisting single-family houses to value by more than 13% in one year. High quality of life and business-friendly environment are assisting the population grow by 1.9% with anticipated family development of 2.4%. Among the top task markets in the country in 2015, rent growth in single-family homes is anticipated to increase by 9% with the population growing by more than 2%.

A worldwide trade seaport and city infrastructure enhancements enhanced financial development, with lease rising by 3.7% last year and homes anticipated https://telegra.ph/the-ultimate-guide-to-what-is-the-deficit-in-mortgages-12-11 to grow by 2.1% this year. Strong local economy in the 2nd-largest city in Texas assisted to drive lease development of 4.2% in 2018. Affordability is attracting millennials from high-priced markets like New York and San Francisco, with single-family house appreciation in Indianapolis growing by 12.8% and rents increasing by 4.1% last year.

9 Simple Techniques For What Do I Do To Check In On Reverse Mortgages

With a new decade just around the corner, wise single-family house financiers are asking which cities will be best for real estate heading into 2020. Every year the Urban Land Institute and international consulting and tax firm PwC lists the top housing markets for the upcoming year. According to the 107-page report on Emerging Trends in Real Estate 2020 the top 10 markets for genuine estate in 2020 are: Austin, Texas Raleigh/Durham, North Carolina Nashville, Tennessee Charlotte, North Carolina Boston, Massachusetts Dallas-Fort Worth, Texas Orlando, Florida Atlanta, Georgia Los Angeles, California Seattle, Washington took a much deeper take a look at these emerging realty patterns and developed five different classifications of hot investment markets for real estate investors to enjoy in 2020.

Paul Sacramento Kansas City Las Vegas Baltimore Washington, D.C. Detroit Markets with a minimum of one million people and population development in the double-digits: Jacksonville Salt Lake City Columbus, Ohio Cincinnati Louisville Greenville, South Carolina Oklahoma City Cape Coral-Fort Myers-Naples, Florida Boise Spokane, Washington Des Moines Tacoma, Washington Jersey City, New Jersey Markets providing the best match in between potential customers and financial investment flows: Fort Lauderdale-Tallahassee-Daytona Beach-Gainesville Richmond, Virginia Birmingham Honolulu Cleveland Albuquerque Omaha Tucson San Antonio Buffalo Under-the-radar markets with low rankings and some weaknesses, but with selective chances when investing for long-term potential: St.

Missouri Memphis New Orleans Providence, Rhode Island Hartford, Connecticut Virginia Beach-Norfolk Milwaukee-Madison Knoxville-Chattanooga, Tennessee Portland, Maine In the next part of this article we'll talk about how to discover markets and single-family rental home based on the 3 primary property financial investment techniques: Cash circulation Appreciation Balance of capital + gratitude However prior to we do, let's discuss what makes a realty market "good" to begin with (what lenders give mortgages after bankruptcy).

" Excellent" pizza, "good" beer, "good" film. everybody has their own opinion of what's excellent and what's not. However when you're investing cash in realty, it's crucial to comprehend precisely what separates excellent property markets from average, not-so-good, and even downright terrible. How to discover a great property market Here are 7 factors that assist make a property market helpful for investors: Task creation above the nationwide average.

Structure allows pulled, existing construction follow this link activity, and forecasted development in realty development. Government planning on both the state and regional level, and whether the town you're considering purchasing is pro-growth or is over-burdened with bureaucracy and policies. what are the different options on reverse mortgages. Housing affordability by utilizing the price-to-rent ratio to compare mean home costs to mean rents.

The 2-Minute Rule for How Do You Reserach Mortgages Records

Flipping a house is the amount of purchasing houses under market worth, repairing them up, and after that offering for a profit. To be a successful flipper, you require to hunt down those deal homes the less work you have to do the better. The perfect flip home would be one that only requires minor cosmetic repairs.

When you decide to flip homes, you have to prepare yourself for the possibility that the home may not sell quick or for much of an earnings. You take a big possibility when turning houses, which is why you have to pay unique attention to the homes area, requires, and rate.

Have a look at this incredible guide to turning homes with little money down. If you aren't sold on the idea of purchasing a home just to recover your cash little by little bit, you could first evaluate the waters by leasing a part of your house. You have a couple of choices to do this.

If you're yet to buy your first home and like this idea you might even purchase a duplex and reside in one home and lease the next. The benefits to leasing a part of your house is that you get to enjoy your tenant closely. It's less most likely that a renter will attempt to stiff you for the lease payment when you're in the same family.

Our buddy Michelle just recently wrote about renting a room to a stranger, which is a fantastic read if you're considering this option. If you believe realty is an excellent financial investment but do not wish to get quite so hands on, you might take your real estate investing to the stock market.Real Estate Investment Trusts (REIT) are excellent ways for you to invest in genuine estate without being actively involved.

There are a couple of different types of REITS; equity, home loans, and hybrid. An equity REIT buys residential or commercial properties, a home loan REIT purchases home mortgages, and a hybrid is the mix of the 2. All 3 generally use high yields basically you make money back from the interest others are paying on their home mortgages.

8 Simple Techniques For How Did Mortgages Cause The Economic Crisis

Some of the more popular REITs include American Capital Agency (NASDAQ: AGNC), Annaly (NYSE: NLY), Realty Earnings (NYSE: O). You can purchase a REIT at your favorite broker - what are the main types of mortgages. We recommend both Fidelity and TD Ameritrade. Nowadays you can invest in almost anything and you ought to do what feels right for you.

If you have been considering attempting your hand at property investing, it's excellent to understand that there's more than one method to go about it. Nonetheless, it is essential to do your due diligence prior to starting with any new financial investment. Alexa Mason is a freelance author and wan na be internet entrepreneur.

All of us understand that genuine estate has to do with location, place, location. However the essential question genuine estate investors is, precisely which place is best for investing? In this short article we'll assist respond to that question by evaluating the top markets for this year, how to pick a market based upon financial investment technique, and the very best cities to purchase genuine estate as we head into 2020.

Previously this summer season he composed a post for titled "Secondary Cities Make Up The 10 Trending Single-Family Rental Markets For Investors In 2019." Using an analysis of information from the U.S. Census Bureau and Zillow Research, Gary recommended smart financiers watch these markets through the 2nd half of 2019: Record levels of convention company and tourist have helped the population of Vegas grow by 2.5% with lease costs increasing by over 10%.

Modern and monetary services companies like Google and BlackRock are broadening thanks to Atlanta's business-friendly environment, helping single-family houses to appreciate by more than 13% in one year. High quality of life and business-friendly environment are assisting the population grow by 1.9% with anticipated family growth of 2.4%. Among the top task markets in the country in 2015, lease growth in single-family houses is anticipated to increase by 9% with the population growing by more than 2%.

A global trade seaport and helping timeshare owners city facilities https://telegra.ph/the-ultimate-guide-to-what-is-the-deficit-in-mortgages-12-11 improvements enhanced financial development, with rent rising by 3.7% last year and homes expected to grow by 2.1% this year. Strong regional economy in the 2nd-largest city in Texas helped to drive rent growth of 4.2% in 2018. Affordability is attracting millennials from high-priced markets like New York and San Francisco, with single-family home gratitude in Indianapolis growing by 12.8% and leas increasing by 4.1% in 2015.

The Facts About Which Of The Following Are Banks Prohibited From Doing With High-cost Mortgages? Uncovered

With a brand-new years just around the corner, smart single-family house financiers are asking which cities will be best for real estate heading into 2020. Every year the Urban Land Institute and worldwide consulting and tax company PwC lists the top real estate markets for the approaching year. According to the 107-page report on Emerging Trends in Real Estate 2020 the leading 10 markets genuine estate in 2020 are: Austin, Texas Raleigh/Durham, North Carolina Nashville, Tennessee Charlotte, North Carolina Boston, Massachusetts Dallas-Fort Worth, Texas Orlando, Florida Atlanta, Georgia Los Angeles, California Seattle, Washington took a much deeper appearance at these emerging property trends and produced five different categories of hot financial investment markets for real estate financiers to watch in 2020.

Paul Sacramento Kansas City Las Vegas Baltimore Washington, D.C. Detroit Markets with a minimum of one million people and population development in the double-digits: Jacksonville Salt Lake City Columbus, Ohio Cincinnati Louisville Greenville, South Carolina Oklahoma City Cape Coral-Fort Myers-Naples, Florida Boise Spokane, Washington Des Moines Tacoma, Washington Jersey City, New Jersey Markets offering the finest match in between prospects and financial investment circulations: Fort Lauderdale-Tallahassee-Daytona Beach-Gainesville Richmond, Virginia Birmingham Honolulu Cleveland Albuquerque Omaha Tucson San Antonio Buffalo Under-the-radar markets with low rankings and some weaknesses, but with selective chances when investing for long-lasting capacity: St.

Missouri Memphis New Orleans Providence, Rhode Island Hartford, Connecticut Virginia Beach-Norfolk Milwaukee-Madison Knoxville-Chattanooga, Tennessee Portland, Maine In the next part of this post we'll talk about how to find markets and single-family rental property based on the three main realty investment techniques: Capital Gratitude Balance of cash circulation + gratitude However prior to we do, let's discuss what makes a real estate market "great" to begin with (mortgages what will that house cost).

" Great" pizza, "great" beer, "good" movie. everyone has their own opinion of what's great and what's not. However when you're investing money in property, it is very important to comprehend exactly what separates good realty markets from average, not-so-good, and even downright awful. How to find a good property market Here are 7 aspects that assist make a property market helpful for financiers: Task development above the nationwide average.

Structure permits pulled, current building and construction activity, and anticipated growth in genuine estate advancement. Federal government preparation on both the state and regional level, and whether or not the municipality you're thinking about investing in is pro-growth or is over-burdened with red tape and guidelines. how do reverse mortgages work in utah. Real estate cost by utilizing the price-to-rent ratio to follow this link compare mean home rates to mean rents.

A Biased View of What Percent Of People In The Us Have 15 Year Mortgages

Likewise, when you link with among the Tampa groups we work with and/or with among our Investment Counselors, make certain to ask about Tampa financial investments that meet our REAL Earnings Home Standards.: Found on the eastern coast of Florida, Jacksonville lines both banks of the St. Johns River the longest river in Florida and likewise one of only two rivers in North America that streams north instead of south.

To date there are over 1.5 million people living in this area, and more continue to come every year. In reality, Jacksonville's population has actually been steadily increasing at a rate of about 2% each year, and their workforce is growing at a consistent rate as well. There are numerous reasons for this growth.

The region likewise has a first-rate health care system, with more than 20 hospitals and a growing bioscience community. Furthermore, 13 of Forbes Global 500 have operations in Jacksonville. With a cost of living listed below the nationwide average, a terrific climate and a business-friendly environment, we believe Jacksonville is one of the very best realty financial investment markets in the nation today.

Future job growth in Jacksonville is predicted to be timeshare ads 39.21% over the next ten years. In Jacksonville, the median home price has to do with $189,000, which http://andersonldox067.image-perth.org/what-kind-of-mortgages-do-i-need-to-buy-rental-properties-fundamentals-explained is 15% less than the national average. A typical 3 bedroom house can lease for around or more than the nationwide average. The expansion of the Panama Canal is assisting to bring jobs into the Jacksonville area ports.

The Jacksonville city also has a world-class healthcare system, with more than 20 hospitals and a growing bioscience neighborhood. There are 3 primary factors that Jacksonville made our list of the best locations to buy property: task development, population development and cost. Forbes also ranked Jacksonville # 3 on their list of best cities in the U.S.

The region also has a world-class healthcare system, with more than 20 medical facilities and a growing bioscience neighborhood. The population in Jacksonville has actually grown practically 15% given that the year 2000, and continues to grow by an average 2% yearly. Future task development over the next 10 years is anticipated to be 39.21%.

The Definitive Guide for How Many New Mortgages Can I Open

A common 3 bed room house can rent for more or around the national average. These aspects show us that there's a strong opportunity for capital in the Jacksonville city. At RealWealth we link investors with residential or commercial property groups in the Jacksonville city location. Presently the teams we work with deal the following rental financial investments: (1) (2) (3) If you wish to view Sample Property Pro Formas, get in touch with one of the teams we deal with in Jacksonville, or talk to one of our Financial investment Counselors about this or other markets, become a member of RealWealth for complimentary.

The fourth-largest city in Alabama, Huntsville is simply a 90-mile drive on the I-65 heading north from Birmingham. Founded in 1811, Huntsville is known for its abundant Southern heritage and a legacy of space objectives. Huntsville really made the nickname "The Rocket City" throughout the 1960s when the Saturn V rocket was developed at Marshall Space Flight Center, which later made it possible for Neil Armstrong and Buzz Aldrin to walk on the moon.

USA Today touted Huntsville as "among the top communities leading the economic recovery," while Cash magazine called it "one of the nation's most economical cities." Huntsville is also popular for its technology, area, and defense markets. The top employer is the military with over 31,000 jobs at Redstone Arsenal.

The city is likewise home to a number of Fortune 500 companies, which offer a broad base of manufacturing, retail, and service markets to the area. We think that Huntsville is another one of the finest locations to purchase rental residential or commercial property in 2020, due to the fact that the realty market uses fantastic chances for financiers today.

These are great signs for financiers interested in producing passive regular monthly earnings. Current Mean Home Price: $158,750 Typical Lease Each Month: $1,075 Typical Home Earnings: $49,060 Population: 462,6931-Year Task Growth Rate: 2.76% 7-Year Equity Development Rate: 34.53% 8-Year Population Development: 10.35% Unemployment Rate: 2.3% Huntsville is house to a number of prestigious Southern universities, consisting of Alabama A&M University, Oakwood University and the University of Alabama in Huntsville.

Space & Rocket Center, Alabama's leading paid traveler destination and the earth's largest space museum, is also found in Huntsville. Huntsville is well understood for it's innovation, area, and defense industries. The leading employer is the military with over 31,000 jobs at Redstone Toolbox. NASA Marshall Space Flight Center are the next largest companies. how many home mortgages has the fha made.

Not known Facts About How Do You Reserach Mortgages Records

Huntsville continues to lead the development in Alabama. In the last eight years the population has actually grown over 10%, which is 80% faster than the nationwide average. Huntsville delights in lower tax rates and high rents, which increase ROI. And because the typical house price is around $158,750, these areas won't break your bank account either.

Huntsville is popular for it's innovation, space, and defense industries. The top company is the military with over 31,000 tasks at Redstone Toolbox. NASA Marshall Space Flight Center are the next largest employers. The city is also home to a number of Fortune 500 companies, which provide a broad base of manufacturing, retail and service industries to the location.

During the same period, the national population grew by only 5.76. This shows us that people are transferring to Huntsville at a higher rate than most other cities across the United States. This type of population development, when paired with economical realty prices and task growth, is a positive indicator that the Huntsville realty market is strong.

Huntsville also delights in lower tax rates and competitive leas, in some neighborhoods as high as 0.97% of the purchase-to-rent ratio, which increases ROI. And the average 3 bed room single household home rate is roughly $158,750, 28% lower than the national average. This makes Huntsville an exceptional place to purchase rental property in 2020.

Presently the teams we deal with offer the following rental financial investments: (1) If you 'd like to view Sample Property Pro Formas, get in touch with one of the teams we deal with in Huntsville, or speak to one of our Investment Therapists about this or other markets, end up being a member of RealWealth totally free.

Found in Northern Texas, Dallas is the fourth most populous cosmopolitan location in the country. Historically, Dallas was one of the most essential centers for the oil and cotton markets due to its tactical position along numerous railroad lines. In the last five years, many business from cities like San Francisco and Los Angeles have actually begun checking out the country to find the best cities for relocation, and many of them have actually targeted Dallas as a prime area to transfer.

5 Simple Techniques For What Happens To Bank Equity When The Value Of Mortgages Decreases

Existing Mean Home Rate: $215,000 Typical Rent Monthly: $1,624 Average Home Income: $79,893 Metro Population: 7.5 M1-Year Task Growth Rate: 2.70% 7-Year Equity Growth Rate: 80.67% 8-Year Population Growth: 17.33% Joblessness Rate: 3.1% Dallas is slightly more inexpensive Learn more than the average home across the country. In 2019, the median purchase price of 3 bedroom single family homes in the Dallas city area was $215,000.

Getting The How To Switch Mortgages While Being To Work

Likewise, when you connect with one of the Tampa groups we work with and/or with one of our Investment Counselors, ensure to inquire about Tampa financial investments that satisfy our REAL Earnings Home Standards.: Found on the eastern coast of Florida, Jacksonville lines both banks of the St. Johns River the longest river in Florida and also among only 2 rivers in The United States and Canada that flows north rather of south.

To date there are over 1.5 million individuals living in this area, and more continue to come every year. In reality, Jacksonville's population has been progressively increasing at a rate of about 2% each year, and their labor force is growing at a consistent rate as well. There are numerous factors for this development.

The area also has a world-class healthcare system, with more than 20 healthcare facilities and a growing bioscience community. In addition, 13 of Forbes Global 500 have operations in Jacksonville. With a cost of living below the nationwide average, a terrific environment and a business-friendly environment, our company believe Jacksonville is among the very best property investment markets in the nation right now.

Future task growth in Jacksonville is anticipated to be 39.21% over the next ten years. In Jacksonville, the typical house price has to do with $189,000, which is 15% less than the nationwide average. A normal 3 bedroom home can lease for around or more than the national average. The growth of the Panama Canal is assisting to bring jobs into the Jacksonville location ports.

The Jacksonville metro also has a world-class health care system, with more than 20 healthcare facilities and a growing bioscience community. There are three primary reasons that Jacksonville made our list of the very best places to purchase residential or commercial property: job growth, population growth and price. Forbes also ranked Jacksonville # 3 on their list of finest cities in the U.S.

The region also has a world-class healthcare system, with more than 20 medical facilities and a growing bioscience neighborhood. The population in Jacksonville has actually Learn more grown nearly 15% considering that the year 2000, and continues to grow by a typical 2% annually. Future job development over the next 10 years is predicted to be 39.21%.

The 9-Second Trick For What Mortgages Do First Time Buyers Qualify For In Arlington Va

A common 3 bed room house can lease for more or around the national average. These aspects reveal us that there's a strong chance for money flow in the Jacksonville metro. At RealWealth we link investors with home groups in the Jacksonville metro location. Currently the teams we deal with offer the following rental financial investments: (1) (2) (3) If you wish to view Sample Residential or commercial property Pro Formas, get in touch with one of the teams we work with in Jacksonville, or talk to one of our Financial investment Counselors about this or other markets, become a member of RealWealth totally free.

The fourth-largest city in Alabama, Huntsville is simply a 90-mile drive on the I-65 heading north from Birmingham. Founded in 1811, Huntsville is understood for its abundant Southern heritage and a legacy of area objectives. Huntsville in fact earned the label "The Rocket City" during the 1960s when the Saturn V rocket was established at Marshall Space Flight Center, which later made it possible for Neil Armstrong and Buzz Aldrin to walk on the moon.

U.S.A. Today touted Huntsville as "one of the leading communities leading the economic healing," while Money publication called it "one of the nation's most budget friendly cities." Huntsville is likewise well known for its innovation, area, and defense industries. The top employer is the military with over 31,000 tasks at Redstone Toolbox.

The city is also home to numerous Fortune 500 business, which offer a broad base of production, retail, and service industries to the location. Our company believe that Huntsville is another one of the finest places to buy rental residential or commercial property in 2020, due to the fact that the property market uses fantastic chances for investors today.

These are excellent indications for financiers thinking about creating passive month-to-month earnings. Current Typical Home Cost: $158,750 Median Lease Monthly: $1,075 Mean Household Earnings: $49,060 Population: 462,6931-Year Task Development Rate: 2.76% 7-Year Equity Development Rate: 34.53% 8-Year Population Growth: 10.35% Unemployment Rate: 2.3% Huntsville is home to numerous prominent Southern universities, including Alabama A&M University, Oakwood University and the University of Alabama in Huntsville.

Space & Rocket Center, Alabama's leading paid tourist attraction and the earth's biggest space museum, is also found in Huntsville. Huntsville is popular for it's innovation, space, and defense industries. The leading employer is the military with over 31,000 jobs at Redstone Toolbox. NASA Marshall Area Flight Center are the next biggest employers. when does bay county property appraiser mortgages.

What Is The Current % Rate For Home Mortgages? - The Facts

Huntsville continues to lead the development in Alabama. In the last eight years the population has grown over 10%, which is 80% faster than the national average. Huntsville takes pleasure in lower tax rates and high leas, which increase ROI. And considering that the typical home rate is roughly $158,750, these locations won't break your savings account either.

Huntsville is popular for it's technology, area, and defense industries. The leading employer is the military with over 31,000 tasks at Redstone Arsenal. NASA Marshall Area Flight Center are the next largest companies. The city is likewise home to several Fortune 500 business, which offer a broad base of production, retail and service industries to the location.

Throughout the same period, the national population grew by just 5.76. This reveals us that individuals are transferring to Huntsville at a higher rate than the majority of other cities across the United States. This kind of population development, when coupled with budget-friendly property costs and task growth, is a favorable indication that the Huntsville realty market is strong.

Huntsville also enjoys lower tax rates and competitive rents, http://andersonldox067.image-perth.org/what-kind-of-mortgages-do-i-need-to-buy-rental-properties-fundamentals-explained in some neighborhoods as high as 0.97% of the purchase-to-rent ratio, timeshare ads which increases ROI. And the typical 3 bedroom single household house cost is approximately $158,750, 28% lower than the national average. This makes Huntsville an excellent location to purchase rental property in 2020.

Currently the teams we deal with offer the following rental investments: (1) If you wish to view Sample Property Pro Formas, get in touch with among the groups we work with in Huntsville, or speak to among our Investment Therapists about this or other markets, end up being a member of RealWealth free of charge.

Located in Northern Texas, Dallas is the 4th most populous urbane location in the nation. Historically, Dallas was one of the most important centers for the oil and cotton industries due to its strategic position along many railroad lines. In the last five years, numerous companies from cities like San Francisco and Los Angeles have actually begun exploring the nation to discover the very best cities for moving, and a number of them have actually targeted Dallas as a prime spot to transfer.

Excitement About How Did Clinton Allow Blacks To Get Mortgages Easier

Present Typical Home Rate: $215,000 Average Rent Monthly: $1,624 Median Family Income: $79,893 City Population: 7.5 M1-Year Task Development Rate: 2.70% 7-Year Equity Development Rate: 80.67% 8-Year Population Growth: 17.33% Unemployment Rate: 3.1% Dallas is a little more economical than the average home nationwide. In 2019, the average purchase rate of 3 bed room single family houses in the Dallas metro location was $215,000.

How Obtaining A Home Loan And How Mortgages Work can Save You Time, Stress, and Money.

All you need to know is where you're looking for homes, your marital status, your annual income, your existing debt and your credit rating. Image credit: iStock. com/ziquiu, iStock. com/courtneyk, iStock. com/bonnie jacobs. Our goal here at Credible Operations, Inc., NMLS Number 1681276, described as "Trustworthy" listed below, is to give you the tools and self-confidence you require to improve your financial resources. Although we do promote items from our partner loan providers, all opinions are our own. Home mortgage points, also called discount rate points, are an alternative for homebuyers looking for the most affordable interest rate on their loan.

Home loan discount points enable you to essentially buy a lower rate of interest when it pertains to home mortgage. Here's how it works: You pay the lending institution for a "point" normally at 1% of your total loan quantity In exchange, they lower your rate, generally by about 0. 25% (however the exact amount varies) A 0.

On a $300,000 loan, for instance with a 20% deposit and no home loan insurance the distinction in between a 3. 50% rate and a 3. 25% rate would be about $33 per month and nearly $12,000 over the life of the loan. $300,000$ 300,000 $60,000$ 60,000 3. 50% 3. 25% $1,078$ 1,045 $147,975$ 136,018 $387,975$ 376,018 All numbers here are for demonstrative functions just and do not represent an ad for offered terms.

In order for points to deserve their price, you will need to reach the breakeven point or the point at which you save more than you invested. In the previous example, a point would cost about $3,000. At a cost savings of $33 monthly, it would take around 91 months (7.

If you don't think you'll remain in the house that length of time, it's most likely not a clever relocate to buy the points. If you do wind up acquiring discount rate points, you can in fact subtract their expenses from your yearly income tax return as long as you detail deductions. You can subtract them for either the year you buy the house or deduct them incrementally across your loan term, depending upon various elements (including the loan purpose).

The Single Strategy To Use For How Does Mortgages Work

The points weren't more than the general average for your area. The points weren't utilized for anything like an appraisal charge, assessment, or another charge. You didn't borrow funds from your lender or broker to pay the points (how do canadian mortgages work). Your closing settlement declaration (or "Closing Disclosure") will likewise require to plainly recognize the points (and their expense).

When looking at your loan price quote, you may see two different type of points: home mortgage points (or discount points) and lending institution Click for source credits. With home mortgage points, you're paying to lower your rate of interest. With loan provider credits, you're accepting pay a greater rates of interest in exchange for decreasing your expenses at closing.

Loan provider credits can be an excellent alternative if you're simply wanting to get in the house with the most affordable upfront expenses. It's also better for short-term buyers (a greater interest rate isn't perfect lauren jenifer gates if you'll be in the home for decades). Lower your interest rateLower your costs at closing Saving money on long-term costsAchieving a lower monthly paymentBuyers who plan to stay https://penzu.com/p/2e8aaea9 in the house for the long haulBuyers with less in savingsBuyers planning to be in the home a short duration Mortgage points can just be bought at closing, so be all set to make a decision early at the same time both when buying a house or making an application for a home loan re-finance.

Shopping around can likewise help give you a better chance at a low rate. Just keep in mind that numerous marketed rates currently have points factored in, so pay very close attention to any loan approximates you get. Points will be noted on Page 2 of the document. If you're prepared to get begun on your home loan rate-shopping journey, or to see what types of home loan, you qualify for, Credible Operations, Inc.

We'll help you compare prequalified rates from multiple lenders in simply minutes. It just takes 3 minutes to see if you qualify for an instantaneous structured pre-approval letter, without impacting your credit. Compare rates from several lending institutions without your data being sold or getting spammed. Total your home mortgage online with bank combinations and automated updates.

How Do Interest Rates On Mortgages Work Fundamentals Explained

About the author Aly J. Yale Aly J. Yale is a home loan and real estate authority and a factor to Credible. Her work has appeared in Forbes, Fox Business, The Motley Fool, Bankrate, The Balance, and more. Home All Home mortgages.

Did you know that home mortgage points can lower your rate of interest? It's true!Here's how home mortgage points work. The lender needs to make a specific amount of interest on a loan. The lending institution could offer you a 5% rate of interest on the loan quantity of $100,000 for thirty years and you would pay $93,256 in interest over the life of the loan.

Here's what I'm discussing. Listed below, is a common rate of interest chart that shows the interest rates for a thirty years home mortgage. A home mortgage point is equivalent to 1% of the loan amount. The math is basic. Increase the loan quantity by the mortgage points and struck the portion secret on your calculator.

Loan Amount100,000 Interest RatePoints30 YearsCost of Points 5. 00% 0. 000536.82$ 0 4. 75% 1. 000521.65$ 1,000 4. 50% 2. 000506.69$ 2,000 4. 25% 3. 000491.94$ 3,000 The reason individuals pay (or purchase) points is since points lower the overall amount of interest paid to the lending institution over the term of the home mortgage. A. Home mortgage points can be beneficial due to the fact that they decrease the overall quantity of interest paid to the loan provider, but, if you're going to remain in your home for a short time duration, then points are bad.

It depends on the lender. Some lenders comprehend that home buyers and homeowners have an aversion towards home loan points, so those lending institutions will call the discount rate point( s) an origination cost instead of call it a discount point. Nevertheless, other loan providers will group all of their costs under an origination cost.

Rumored Buzz on How Do Adjustable Rate Mortgages Work

Provided you (and the home) meet the basic loan certifications, there is no reason that you can't get a loan (home loan) on the house. A. Points are pre-paid interest. Points decrease the rate of interest on the loan, not the principal. A. Usage our additional payment calculator to estimate the over payment each monthA.

The total number of points will depend upon the lender and kind of loan (i. e. standard versus FHA). There is a decreasing return with mortgage points. Normally, as the points go beyond 3 points, the worth reduces. A. Simply as paying points lower the rates of interest, increasing the rates of interest reduces the number of points.

Our Obtaining A Home Loan And How Mortgages Work Diaries

Customers seeking to lessen their short-term rate and/or payments; homeowners who http://lanelrdj509.iamarrows.com/not-known-incorrect-statements-about-how-do-reverse-annuity-mortgages-work prepare to relocate 3-10 years; high-value borrowers who do not wish to tie up their cash in house equity. Borrowers who are unpleasant Visit this page with unpredictability; those who would be financially pressed by higher mortgage payments; debtors with little house equity as a cushion for refinancing.

Long-term mortgages, financially inexperienced customers. Buyers buying high-end residential or commercial properties; borrowers installing less than 20 percent down who want to prevent spending for mortgage insurance. Property buyers able to make 20 percent down payment; those who expect increasing house values will enable them to cancel PMI in a couple of years. Debtors who need to borrow a lump sum money Check over here for a particular purpose.

Those paying an above-market rate on their main home loan may be much better served by a cash-out refinance. Borrowers who require need to make periodic expenses gradually and/or are not sure of the overall quantity they'll require to borrow. Borrowers who require to obtain a single swelling amount; those who are not disciplined in their spending habits (what is the maximum debt-to-income ratio permitted for conventional qualified mortgages). why were the s&ls stuck with long-term, non-liquid mortgages in the 1980s?.

Some Known Incorrect Statements About Reverse Mortgages How They Work

All you require to know is where you're searching for homes, your marital status, your yearly earnings, your existing financial obligation and your credit report. Picture credit: iStock. com/ziquiu, iStock. com/courtneyk, iStock. com/bonnie jacobs. Our goal here at Credible Operations, Inc., NMLS Number 1681276, referred to as "Reliable" below, is to provide you the tools and self-confidence you need to enhance your finances. Although we do promote items from our partner lending institutions, all opinions are our own. Home loan points, also called discount points, are a choice for property buyers looking for the most affordable rates of interest on their loan.

Home mortgage discount points enable you to essentially buy a lower rates of interest when it comes to mortgage. Here's how it works: You pay the lender for a "point" usually at 1% of your total loan amount In exchange, they lower your rate, normally by about 0. 25% (however the exact amount varies) A 0.

On a $300,000 loan, for example with a 20% deposit and no home loan insurance coverage the difference in between a 3. 50% rate and a 3. 25% rate would be about $33 each month and almost $12,000 over the life of the loan. $300,000$ 300,000 $60,000$ 60,000 3. 50% 3. 25% $1,078$ 1,045 $147,975$ 136,018 $387,975$ 376,018 All numbers here are for demonstrative purposes only and do not represent an ad for offered terms.

In order for indicate deserve their price, you will need to reach the breakeven point or the point at which you save more than you spent. In the previous example, a point would cost about $3,000. At a savings of $33 per month, it would take around 91 months (7.

If you don't think you'll remain in the house that length of time, it's probably not a smart transfer to purchase the points. If you do end up buying discount points, you can really deduct their expenses from your annual tax returns as long as you itemize deductions. You can deduct them for either the year you acquire the home or subtract them incrementally across your loan term, depending upon different aspects (including the loan function).

How How Do Va Mortgages Work can Save You Time, Stress, and Money.

The points weren't more than the basic average for your location. The points weren't used for anything like an appraisal fee, assessment, or another charge. You didn't borrow funds from your lending institution or broker to pay the points (obtaining a home loan and how mortgages work). Your closing settlement declaration (or "Closing Click for source Disclosure") will likewise require to clearly recognize the points (and their expense).

When taking a look at your loan quote, you may see 2 different kinds of points: mortgage points (or discount rate points) and lender credits. With home loan points, you're paying to decrease your interest rate. With lending institution credits, you're concurring to pay a greater rate of interest in exchange for reducing your costs at closing.

Loan provider credits can be a great option if you're just wanting to get in the house with the most affordable upfront costs. It's likewise better for short-term purchasers (a higher interest rate lauren jenifer gates isn't ideal if you'll be in the house for decades). Lower your interest rateLower your expenses at closing Minimizing long-lasting costsAchieving a lower regular monthly paymentBuyers who prepare to remain in the home for the long haulBuyers with less in savingsBuyers planning to be in the house a short duration Mortgage points can only be purchased at closing, so be ready to make a choice early while doing so both when purchasing a house or getting a home loan refinance.

Shopping around can also assist offer you a much better chance at a low rate. Simply keep in mind that numerous advertised rates currently have points factored in, so pay very close attention to any loan approximates you get. Points will be noted on Page 2 of the document. If you're prepared to begin on your home mortgage rate-shopping journey, or to see what types of mortgage, you receive, Credible Operations, Inc.

We'll assist you compare prequalified rates from multiple lending institutions in simply minutes. It only takes 3 minutes to see if you get approved for an instant streamlined pre-approval letter, without affecting your credit. Compare rates from numerous lending institutions without your data being offered or getting spammed. Total your mortgage online with bank integrations and automated updates.

Not known Incorrect Statements About How Do Points Work In Mortgages

About the author Aly J. Yale Aly J. Yale is a home mortgage and real estate authority and a contributor to Reputable. Her work has appeared in Forbes, Fox Company, The Motley Fool, Bankrate, The Balance, and more. Home All Mortgages.

Did you understand that home loan points can decrease your interest rate? It's true!Here's how home loan points work. The lender requires to make a particular amount of interest on a loan. The lender might offer you a 5% rate of interest on the loan amount of $100,000 for 30 years and you would pay $93,256 in interest over the life of the loan.

Here's what I'm talking about. Listed below, is a typical rate of interest chart that shows the interest rates for a 30 year home mortgage. A home loan point is https://penzu.com/p/2e8aaea9 equivalent to 1% of the loan amount. The mathematics is easy. Multiply the loan quantity by the mortgage points and hit the percentage secret on your calculator.

Loan Amount100,000 Interest RatePoints30 YearsCost of Points 5. 00% 0. 000536.82$ 0 4. 75% 1. 000521.65$ 1,000 4. 50% 2. 000506.69$ 2,000 4. 25% 3. 000491.94$ 3,000 The factor individuals pay (or purchase) points is due to the fact that points lower the total amount of interest paid to the lending institution over the term of the home mortgage. A. Home mortgage points can be useful due to the fact that they lower the total amount of interest paid to the lending institution, but, if you're going to remain in your home for a short time duration, then points are bad.

It depends on the lending institution. Some loan providers comprehend that home buyers and property owners have a hostility toward mortgage points, so those loan providers will call the discount rate point( s) an origination charge rather than call it a discount point. However, other lenders will group all of their costs under an origination cost.

A Biased View of How Do Escrow Accounts Work For Mortgages

Offered you (and the home) meet the basic loan qualifications, there is no reason that you can't get a loan (mortgage) on the home. A. Points are pre-paid interest. Points lower the interest rate on the loan, not the principal. A. Use our additional payment calculator to estimate the over payment each monthA.

The overall number of points will depend upon the loan provider and kind of loan (i. e. conventional versus FHA). There is a diminishing return with home loan points. Usually, as the points surpass 3 points, the worth decreases. A. Just as paying points decrease the rate of interest, increasing the rates of interest reduces the variety of points.

The Only Guide for How Do Fha Va Conventional Loans Abd Mortgages Work